It seems that ‘boomers’ are forever scrutinising the younger generation for their frivolous spending habits. No matter whether it’s too many trips to coffee shops or too many avocados, it seems like there’s nothing that millennials can do to appease their older counterparts.

Many boomers cite these careless spending habits as the main reason why millennials can’t afford to buy houses and save for retirement, and why they choose to rent instead.

On the other hand, data from All Agents shows that the average real UK house price almost doubled between 2008 and 2018, whereas average real weekly wages decreased by 3% over the same time period.

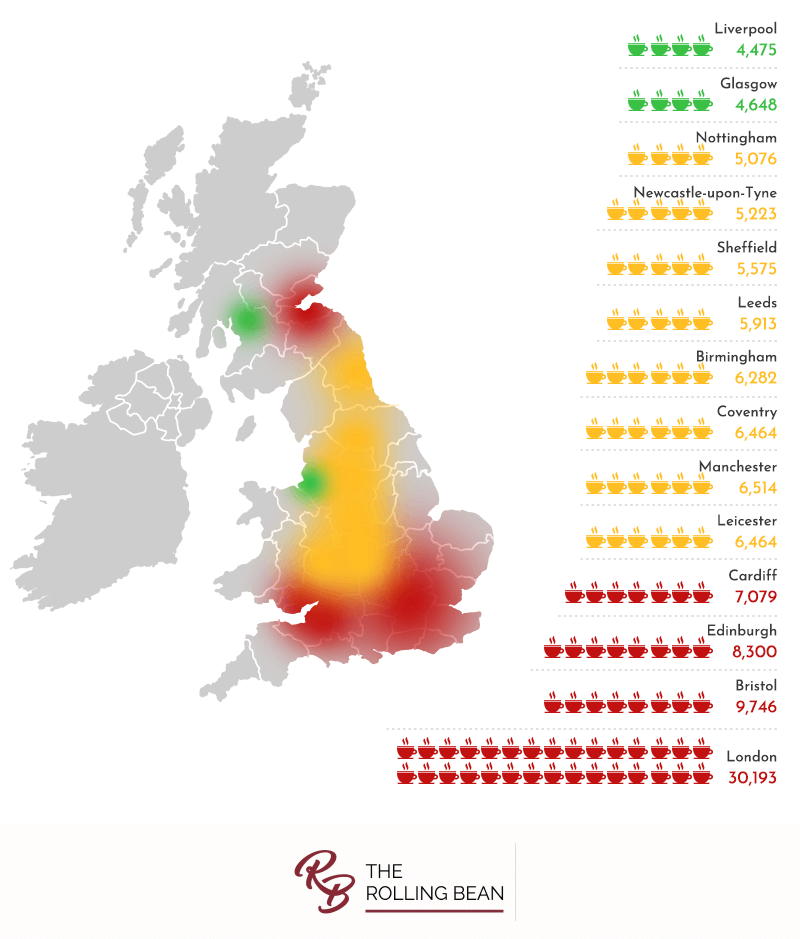

So, we decided to put the boomers’ ridiculous theory to bed once and for all. Yes, that’s right, we’ve worked out just how many coffees millennials need to forgo to buy their first home. Here’s what we found out:

According to data from the UK land registry, Liverpool homeowners get the most value for money when it comes to buying their first home. On average, first-time buyers in the city pay £119,040 for their first properties.

We did the same analysis for 13 more major cities around the UK. Here’s what we found:

|

UK City |

Average latte price |

First-time buyer house price in £’s (March 2020 data) |

Deposit (10%) |

Number of coffees needed to save for deposit |

|

Liverpool |

2.66 |

119040 |

11904.00 |

4475.18797 |

|

Glasgow |

2.61 |

121314 |

12131.40 |

4648.045977 |

|

Nottingham (City of) |

2.61 |

132494 |

13249.40 |

5076.398467 |

|

Newcastle |

2.67 |

139453 |

13945.30 |

5222.958801 |

|

Sheffield |

2.61 |

145510 |

14551.00 |

5575.095785 |

|

Leeds |

2.66 |

157279 |

15727.90 |

5912.744361 |

|

Birmingham |

2.60 |

163323 |

16332.30 |

6281.653846 |

|

Coventry |

2.61 |

168713 |

16871.30 |

6464.099617 |

|

Manchester |

2.61 |

170023 |

17002.30 |

6514.291188 |

|

Leicester |

2.64 |

170646 |

17064.60 |

6463.863636 |

|

Cardiff |

2.61 |

184749 |

18474.90 |

7078.505747 |

|

Edinburgh (City of) |

2.61 |

216622 |

21662.20 |

8299.693487 |

|

Bristol |

2.67 |

260219 |

26021.90 |

9746.029963 |

|

London (City of) |

2.69 |

812193 |

81219.30 |

30193.04833 |

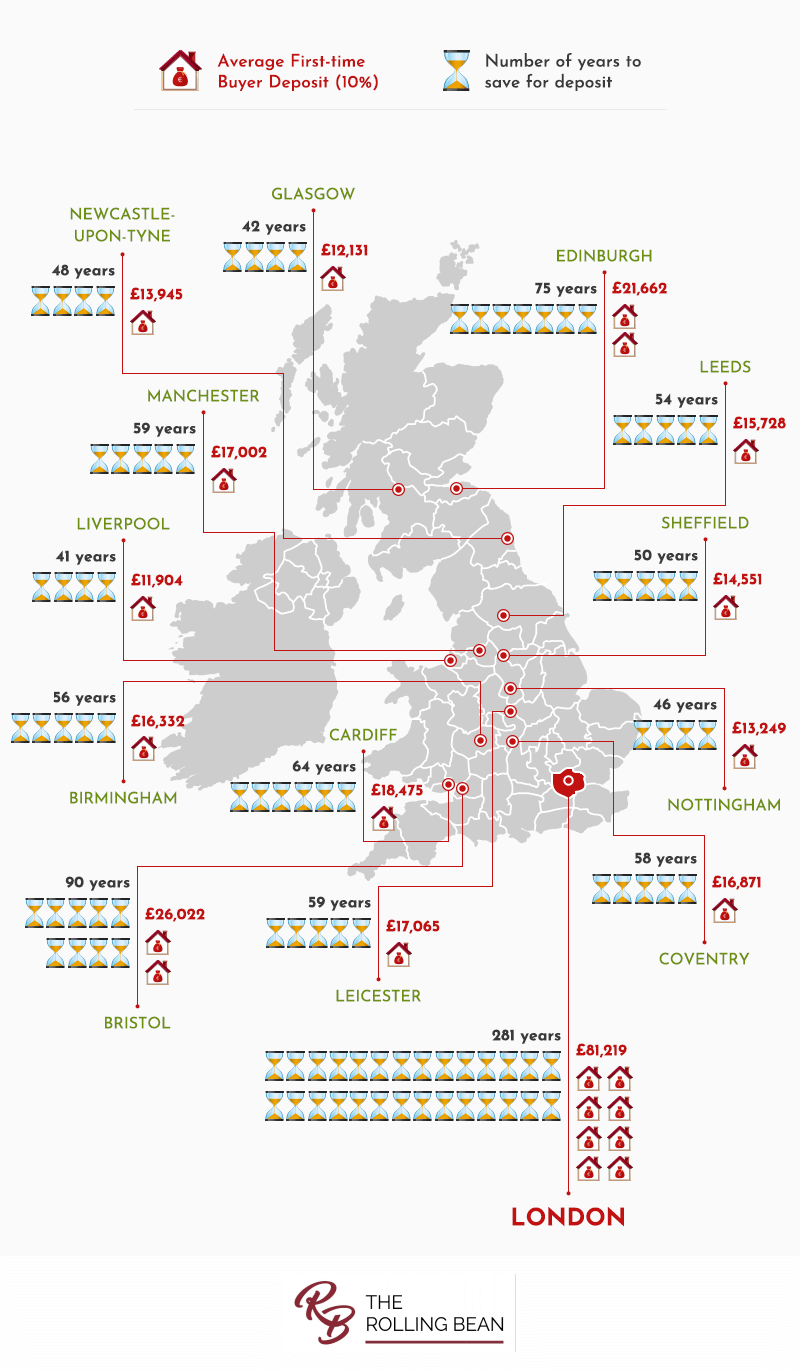

It would take over 280 years to save cash to buy a property in London!

It seems that even the most frugal millennials don’t stand a chance at buying a property in central London. According to a recent study by Dacia, millennials spend around £5.50 per week on coffee. This means that it would take an eye-watering 280 years to save up for a deposit in the city. Scary stuff, right?

Using this information plus our own data, we’ve worked out just how long it would take you to save enough money for a house deposit in different cities in the UK.

|

UK City |

Average latte price |

First-time buyer house price in £’s (March 2020 data) |

Deposit (10%) |

Amount of money spent per week on coffees |

No of weeks in a year |

Amount spent on coffee per year |

No years to save for deposit |

|

Liverpool |

2.66 |

119040 |

11904.00 |

5.56 |

52 |

289.12 |

41.17 |

|

Glasgow |

2.61 |

121314 |

12131.40 |

5.56 |

52 |

289.12 |

41.96 |

|

Nottingham (City of) |

2.61 |

132494 |

13249.40 |

5.56 |

52 |

289.12 |

45.83 |

|

Newcastle |

2.67 |

139453 |

13945.30 |

5.56 |

52 |

289.12 |

48.23 |

|

Sheffield |

2.61 |

145510 |

14551.00 |

5.56 |

52 |

289.12 |

50.33 |

|

Leeds |

2.66 |

157279 |

15727.90 |

5.56 |

52 |

289.12 |

54.40 |

|

Birmingham |

2.60 |

163323 |

16332.30 |

5.56 |

52 |

289.12 |

56.49 |

|

Coventry |

2.61 |

168713 |

16871.30 |

5.56 |

52 |

289.12 |

58.35 |

|

Manchester |

2.61 |

170023 |

17002.30 |

5.56 |

52 |

289.12 |

58.81 |

|

Leicester |

2.64 |

170646 |

17064.60 |

5.56 |

52 |

289.12 |

59.02 |

|

Cardiff |

2.61 |

184749 |

18474.90 |

5.56 |

52 |

289.12 |

63.90 |

|

Edinburgh (City of) |

2.61 |

216622 |

21662.20 |

5.56 |

52 |

289.12 |

74.92 |

|

Bristol |

2.67 |

260219 |

26021.90 |

5.56 |

52 |

289.12 |

90.00 |

|

London (City of) |

2.69 |

812193 |

81219.30 |

5.56 |

52 |

289.12 |

280.92 |

Many millennials would need to start saving before they were born in order to buy a house in their lifetime

In other words, it would be impossible to give up enough takeaway coffees to be able to afford a home in one of the UK’s major cities. Even the government’s efforts aimed at helping first-time buyers get on the property ladder, could be doing more harm than good.

Recent stamp duty land tax cuts caused a mini-boom in property prices in London’s commuter belt. The knock-on effect of this means that those with the cash will be able to buy, whereas, it will hinder those who are looking to escape the cycle of renting.

"In the 1980's, it would have taken a typical household in their late 20s around 3 years to save for an average-sized deposit. It would now take 19 years."

Source: TIC Finance

Lattes aside, it seems that the odds are stacked against millennials when it comes to getting on the property ladder. With wages rising at a slower rate than property prices, millennials' inability to access affordable housing simply cannot be attributed to their so-called ‘frivolous’ spending habits.

What do you think? Do millennials have it easier than the older generation? Or are there factors beyond their control that are hindering their success?

FULL DATASET:

Other sources: